Acording to he information presented to the Chilean Securities and Insurance Supervisor (SVS), Colbún reached a profit of USD $ 24.4 millions in the period ended on march, 31, 2013. This results is an increase from the USD $ 9.2 obtained in the same three months of the previous year.

Acording to he information presented to the Chilean Securities and Insurance Supervisor (SVS), Colbún reached a profit of USD $ 24.4 millions in the period ended on march, 31, 2013. This results is an increase from the USD $ 9.2 obtained in the same three months of the previous year.In the quarter recently ended, Colbun's EBIDTA obtained a result of USD $ 89.2 millions, more than 3 times higher than the USD $ 27.4 from march, 2012. This numbers are the results of a more balanced trade position and an improved cost structure.

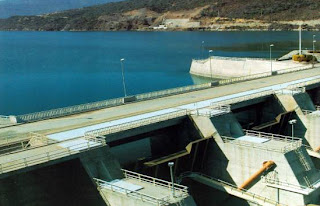

Hidraulic generation of the period reached 1,052 GWh, decreasing 26.6% from the 1Q12. This decrease is mainly due to lower dispatch of Central Colbún during the period, due to the schedule of the CDEC. Despite this, total generation of the period reached 3.055 GWh.

Physical sales to customers under contract during 1Q13 totaled 2,569 GWh, 10.7% lower than physical sales under contract in the same period of the last year, mainly due to lower sales to free customers. In march came, a new contract with Codelco started, which replaces the contract finalized in March 2012. Note that this new document considers the current market conditions and cost structure in which Colbún are operating.

At the end of the first quarter of 2013, Colbún has a liquidity of USD $ 237.6 million.

Comentarios

Publicar un comentario